Option Straddle Series - P&L Exits

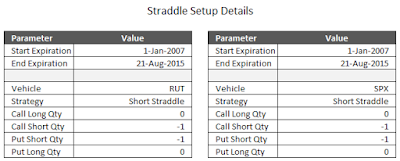

During the next several weeks, I will show the backtest results for selling Straddles on the S&P 500 Index (SPX) and the Russell 2000 Index (RUT). The prior post, Introduction To Options Straddles, introduced Straddles and compared them with Iron Butterflies. For this new series, we will look at the following setup:

These short Straddles will be entered atfive four different days-to-expiration (DTE): 38, 45, 52, 59 , and 66. The core of this series is related to the exits. I am going to follow the loss exit approach discussed on the Tastytrade Exiting Straddles episode:

These exits can also be thought of as risk:reward exits. Using the prior example of the Straddle (25:10), we are risking 25% to make 10%. These odds don't sound great from a classical stock strategy approach, but the win rate and probabilities of profit are key components of the Straddle strategy's profitability.

If you don't want to miss my new blog posts, follow my blog either by email, RSS feed or by Twitter. All options are free, and are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter". I follow blogs by RSS using Feedly, but any RSS reader will work.

|

| (click to enlarge) |

These short Straddles will be entered at

- Straddle (25:NA) - exit if the trade has a loss of 25% of its initial credit OR at Expiration.

- Straddle (50:NA) - exit if the trade has a loss of 50% of its initial credit OR at Expiration.

- Straddle (75:NA) - exit if the trade has a loss of 75% of its initial credit OR at Expiration.

- Straddle (100:NA) - exit if the trade has a loss of 100% of its initial credit OR at Expiration.

- Straddle (125:NA) - exit if the trade has a loss of 125% of its initial credit OR at Expiration.

- Straddle (150:NA) - exit if the trade has a loss of 150% of its initial credit OR at Expiration.

- Straddle (175:NA) - exit if the trade has a loss of 175% of its initial credit OR at Expiration.

- Straddle (200:NA) - exit if the trade has a loss of 200% of its initial credit OR at Expiration.

For the eight options above, there are no profit related exits...they either exit for a loss or exit at expiration. To clarify how these exits function, let's look at an example of the Straddle (100:NA) variation. In this example, if we sell a 1-lot Straddle for $2,000, we would take our loss when the Straddle had to be ought back at $4,000. $4,000 - $2,000 = $2,000, or a loss of 100% of our initial credit.

For each of these eight loss based exits, I will also look at taking profits at 10%, 25%, 35%, and 45% of the initial credit received. These percentages will replace the NA in the variations above. For example, Straddle (25:10) would exit if the trade had a loss of 25% of its initial credit, OR if the trade had a profit of 10% of its initial credit, or at expiration. In total I will show the results for 40 different exit approaches

For each of these eight loss based exits, I will also look at taking profits at 10%, 25%, 35%, and 45% of the initial credit received. These percentages will replace the NA in the variations above. For example, Straddle (25:10) would exit if the trade had a loss of 25% of its initial credit, OR if the trade had a profit of 10% of its initial credit, or at expiration. In total I will show the results for 40 different exit approaches

These exits can also be thought of as risk:reward exits. Using the prior example of the Straddle (25:10), we are risking 25% to make 10%. These odds don't sound great from a classical stock strategy approach, but the win rate and probabilities of profit are key components of the Straddle strategy's profitability.

If you don't want to miss my new blog posts, follow my blog either by email, RSS feed or by Twitter. All options are free, and are available on the top of the right hand navigation column under the headings "Subscribe To RSS Feed", "Follow By Email", and "Twitter". I follow blogs by RSS using Feedly, but any RSS reader will work.